Sberbank Online: login to your personal account. Sberbank Online: login to your personal account What is the fee for withdrawing cash from a Sberbank ATM

Sberbank of Russia is the largest bank in our country, which has representative offices and branches in every city in the Russian Federation. It is Sberbank that provides the most wide range services to individuals and corporate clients. The peculiarity of the bank is that it is here that about 70% of all banking clients are served; accordingly, the level of its service meets the highest requirements of a private client. However, let us consider in order all the services of Sberbank for individuals for today.

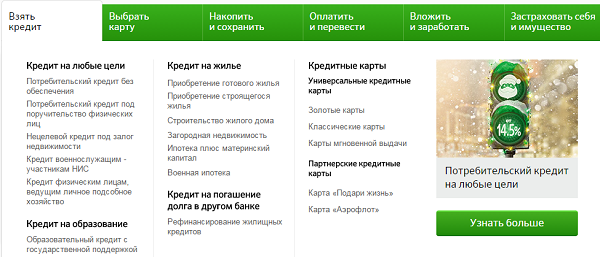

Lending to individuals

At all times, consumer lending has been one of the most popular banking products. At Sberbank, individuals have the opportunity to obtain a non-targeted loan in the amount of up to one and a half million rubles. The bank offers several loan programs with different interest rates:

- consumer loan without collateral from 13.9% per year;

- loan guaranteed by individuals rate from 12.9% per year;

- loan for private household plots rate from 17% per year;

- loan to military personnel for NIS participants - interest rate from 13 5% per year;

- loan secured by real estate from 12% per year.

As you can see, the rates on non-targeted consumer loans are quite low, and the bank gives greater preference to salary clients; it is for them that the minimum annual interest. The annual rate will be increased if the borrower refuses personal risk insurance.

Please note that for each potential borrower the terms of the loan are strictly individual and will depend on many factors.

Mortgage credit lending

Sberbank specializes in issuing mortgage loans; it is the leader in issuing loans for the purchase of housing. There are several programs for potential borrowers:

- Purchase of finished housing – rate from 8.9%.

- Promotion for new buildings – 7.4% per year.

- Mortgage plus maternity capital - interest rate from 8.9% per year.

- Loan for the construction of a residential building - interest rate 10% per annum.

- Military mortgage - rate from 10.9% per year.

You can apply for a mortgage loan without leaving your home on the bank’s official website. The processing time for an application can be up to 5 working days. Here mortgages are available to citizens of the Russian Federation aged from 21 to 65 years inclusive.

Loan refinancing

Sberbank offers individuals a service such as refinancing loans from other banks. This service is beneficial for you clients who pay off loans from other banks with a high interest rate or have several loans in different banks. The essence of refinancing is that Sberbank repays the client’s loans using his loan funds, after which the borrower pays only one loan to Sberbank. The benefit of the service is that the interest rate on a refinancing loan is several points lower than rates in other banks. In addition, it is possible to receive funds for emergency expenses.

Please note that refinancing a loan from other banks is only available to customers who do not have any current overdue debt.

Plastic cards

Credit and debit cards are always in great demand among individuals. Sberbank offers a wide selection of plastic cards that can meet the needs of each client. Here you can apply for a card from the Visa, MasterCard and Mir payment systems. Depending on your income level, the bank offers classic and gold platinum cards. In addition, here the client can issue a co-branded card, for example, Sberbank Aeroflot Bonus, or take part in the Gift of Life charity program.

The main advantage of Sberbank is that it offers its users to issue a card with an individual design. The cost of such a service is only 500 rubles. By the way, it is impossible not to say that it is in Sberbank that you can issue a debit card for a minor child over 7 years old. Her account will be linked to her parents' main card. And here you can get an instant card in just 15 minutes.

Please note that the cost of servicing a plastic card depends on several factors, primarily its status.

Invest and earn

Surely every potential client is interested in the opportunity to make money with Sberbank. And here such an opportunity is provided. Here you can open a deposit on favorable terms; the bank offers several deposit offers with different service conditions and interest rates. In addition, the bank's card clients have the opportunity to receive a higher interest rate on their deposit when opening an account remotely, through Sberbank online.

You can also open a nominal account at Sberbank for depositing social benefits. Its peculiarity is that it has no term limits, and also allows its users to receive up to 3.67% in rubles on the account balance. The minimum balance amount is not limited. The bank offers the following investment services to private clients:

- individual investment account;

- mutual funds;

- protected investment program;

- endowment life insurance.

What are Sberbank investment services for individuals. First of all, this is a real opportunity to earn additional money. If we talk in simple words, then the bank takes the money of its clients in trust and invests them in reliable projects, which in the future bring passive income to the owner of the investment.

The bank offers such a service as an individual pension plan, that is, in fact, it is a non-state Pension Fund Sberbank. Individuals have the opportunity to independently form the funded part of their future pension. To use this service, you just need to open an account remotely, then sign an agreement, which the bank employees will send by email, and deposit an amount from the card of at least 1,500 rubles; in the future, the account can be topped up with at least 500 rubles at a time.

Important! The funds in the pension account are reliably protected; they are not subject to seizure or collection.

Brokerage services

Sberbank brokerage services for individuals are purchased in Lately enough high popularity. First of all, it should be noted that an individual does not have the opportunity to become a private investor without intermediaries, or, more precisely, to invest his capital in securities. Here the bank offers a unique opportunity to conclude a service agreement and become a full participant in trading on the Moscow Exchange.

The cost of Sberbank brokerage services for individuals ranges from 0.165% to 0.006% depending on the transaction amount. It is worth noting that the service is carried out at each Sberbank office, Currently, 180,000 private investors have used the service. In order to become a client, you just need to contact any bank branch and conclude an agreement.

Payments and transfers

Sberbank of Russia provides the opportunity to pay for various services in several ways: using remote services, bank cash desks or self-service devices. You can make the following payments:

- public utilities;

- traffic police fines;

- taxes;

- cellular communication services;

- Internet;

- loans from other banks.

If you are a card client of the bank, then it is possible to make all payments online through the Sberbank online system. Tariffs for Sberbank services for individuals are quite loyal; to make payments to government and non-government organizations you will have to pay a 3% commission; for housing and communal services and mobile phone There is a 2% commission. When paying for a loan from Sberbank, as well as a transfer to charity, no commission is charged for tax fees.

Important! The minimum commission fee is at least 20 rubles.

other services

The services of Sberbank of Russia provided to individuals are quite diverse. For example, here, in addition to a standard cash deposit, you can open a metal account. The essence of the service is that you buy precious metal or coins made of precious metals from Sberbank, and make a profit in the form of the difference in cost. Among other things, you can pick up the metal in an ingot or receive it in monetary terms.

Sberbank also provides rental services for safe deposit boxes at an affordable cost. Unfortunately, not all Sberbank banks yet have specialized premises with bank safes, therefore this information should be clarified in advance. The cost of rent depends on several factors, primarily on the size of the bank safe and the period of its use.

You cannot ignore the bank's insurance services. The bank offers several types of insurance, namely: personal risk insurance, property insurance, travel insurance and comprehensive insurance. On the bank's official website you can choose the type of protection that you or your relatives need. The cost of the policy and the amount of insurance coverage directly depends on the set of insurance risks. You can purchase a policy directly at the office of a financial institution or online on the bank’s website. But it is worth considering that the service is provided by the Sberbank Insurance company, which is a 100% subsidiary of Sberbank of Russia.

Remote services

Finally, another service Sberbank provides to individuals is remote services: Internet banking and SMS notifications. First of all, these services are available to plastic card users. To gain access to them, you simply need to first issue a plastic card, then connect all services to a Sberbank branch or through an ATM.

As for the cost of remote services, there is no fee for Internet banking. In addition, if you have access to your personal account in the system, you can download it for free mobile app Sberbank Online and has access to your personal account at any time of the day, regardless of location. For SMS notification to Mobile Bank you will have to pay a symbolic cost, which ranges from 0 to 60 rubles. For gold and credit cards, payment is 0 rubles.

Sberbank has been providing services to individuals for over 100 years. Moreover, it really offers the widest range of services for individuals. By the way, if you want to become a client of the bank, you can find a description of each service and its cost on the official website.

The history of Sberbank of Russia begins with the personal decree of Emperor Nicholas I of 1841 on the establishment of savings banks, the first of which opened in St. Petersburg in 1842. A century and a half later, in 1987, on the basis of state labor savings banks, a specialized bank for labor savings and lending to the population was created - Sberbank of the USSR, which also worked with legal entities. The Sberbank of the USSR included 15 republican banks, including the Russian Republican Bank.

In July 1990, by a resolution of the Supreme Council of the RSFSR, the Russian Republican Bank of Sberbank of the USSR was declared the property of the RSFSR. In December 1990 it was transformed into a joint stock company commercial Bank, which was legally established at the general meeting of shareholders on March 22, 1991. In the same 1991, Sberbank became the property of the Central Bank of the Russian Federation and was registered as a joint-stock commercial Savings Bank Russian Federation.

In 1998, Sberbank managed to withstand the default on GKO-OFZ, largely thanks to the support of the Central Bank of the Russian Federation and an increase in fees for settlement services. At that time, the share of government debt obligations in the bank’s assets was 52%, and the loan portfolio accounted for only 21% of net assets.

In September 2012, the Central Bank of the Russian Federation sold a 7.6% stake in Sberbank to private investors for 159 billion rubles, or almost $5 billion. The bank's ordinary and preferred shares have been listed on Russian stock exchanges since 1996, and American Depository Receipts (ADRs) on the London Stock Exchange. stock exchange, Frankfurt Stock Exchange and on the over-the-counter market in the USA.

In 2012, Sberbank closed a merger deal with the investment company Troika Dialog (transformed into the corporate investment structure Sberbank CIB, and the retail bank Troika Dialog was sold to a group of private investors in the fall of 2013).

Also in 2012, a deal was closed for Sberbank to purchase from the French group BNP Paribas a majority stake in its subsidiary Russian retail bank (now the joint venture operates as Cetelem Bank, Sber's share of 79.2% has not changed since May 30, 2018).

In 2013, the Sberbank brand was officially launched in Europe. The purchase of DenizBank was completed in September 2012 and became the largest acquisition in the bank's more than 170-year history. However, in May 2018, Sberbank entered into a binding agreement to sell its business in Turkey. In July 2019, the sale of DenizBank was closed.

Sberbank accounts for about 41% of all loans to individuals, as well as more than a third of private deposits and loans legal entities in Russia. Back in 2012, Sberbank overtook the former leader in the credit card segment - Russian Standard Bank. The share of Sberbank's mortgage portfolio in the structure of such a portfolio in the banking system as a whole is about 57%.

Sberbank ranks 32nd in the world in the annual ranking “1,000 largest banks in the world 2019” by The Banker magazine.

As of August 1, 2019, the volume of net assets of the credit institution amounted to 28.83 trillion rubles, the volume of equity funds – 4.30 trillion rubles. At the end of the first half of 2019, the bank showed a profit of 519.67 billion rubles.

Network of divisions:

head office (Moscow);

2 representative offices (Beijing, China; Frankfurt am Main, Germany);

89 branches (88 in the Russian Federation, 1 in New Delhi, India);

13,220 additional offices;

578 operational offices;

285 mobile cash registers;

90 operating cash desks outside the cash desk.

The geography of Sberbank Group covers 21 countries, including the Russian Federation. In addition to the CIS countries, Sberbank is represented in Central and Eastern Europe (Sberbank Europe AG, former Volksbank International), Great Britain and the USA, Cyprus and a number of other countries (corporate and investment business of the Sberbank CIB Group).

Owners:

Bank of Russia (Central Bank of the Russian Federation) – 50.0% + 1 share;

shares in public circulation – 50.0% – 1 share.

A share of 45.04% (shares in public circulation) belongs to non-resident legal entities. The total number of bank owners exceeds 253 thousand shareholders.

Supervisory Board: Sergey Ignatiev (chairman), Gennady Melikyan, German Gref, Sergey Shvetsov, Nadezhda Ivanova, Bella Zlatkis, Olga Skorobogatova, Maxim Oreshkin, Valery Goreglyad, Nikolay Kudryavtsev, Leonid Boguslavsky, Alexander Kuleshov, Esko Aho, Nadya Wells.

Governing body: German Gref (Chairman, President), Alexander Vedyakhin, Lev Khasis, Oleg Ganeev, Bella Zlatkis, Svetlana Kirsanova, Stanislav Kuznetsov, Alexander Morozov, Anatoly Popov.

It has a rich history and impeccable reputation. This is a serious, stable bank, trusted by millions. Sberbank of Russia is always nearby!

Over its long history of development, the bank has managed to maintain its main qualities and today is a clear indicator of professionalism. This is modern financial enterprise, which follows the best traditions. That is why more and more Russians give preference to it.

Sberbank of Russia today

Sberbank of Russia takes an active part in all aspects of the life of the population. He is familiar to both young people and older people. The once famous savings banks and savings books are still associated with stability and reliability. The modern generation is well versed in existing proposals on the country's financial market and chooses for himself best options.

The issue of investing money worries many. It is important to manage your funds wisely and choose a reliable partner. Sberbank of Russia maintains its stability under any circumstances. Thanks to flexible programs and loyal conditions, it has gained popularity among the population. The Savings Bank of the Russian Federation operates throughout the country. You can find contact details of the main branch and representative offices in the regions, as well as details and directions, on our website.

PJSC Sberbank of Russia

For the convenience and comfort of customers, our website was created as information resource. With its help, you can quickly navigate the numerous services provided by Sberbank of Russia. Here you will find practical recommendations, advice, get the necessary links, information about branches, their locations, contact information. On our website you can get acquainted with the services provided; all current offers and client programs are collected here.

MORTGAGE FOR A YOUNG FAMILY

ONLINE BANKING

Sberbank online is a great opportunity to make a lot of financial transactions without leaving your home: pay for utilities, instant transfers to anywhere in the world and much more. This service will appeal to everyone who values their time and efficiency. We invite you to familiarize yourself with the instructions for connecting to this service and its advantages.

Sberbank of Russia is the very first credit organization in the country. More than 50% of Russian citizens are clients of the financial institution. Like others credit organizations, Sber has its own website.

Most of the bank's clients use its services in the traditional form. The official website of Sberbank allows you to perform almost the same operations much faster, without queues or delays. Let's find out what functionality the Sberbank website has, how a client can find the necessary data, etc.

Home page

A conservative approach to the provision of services is also reflected in the design of the official website of Sberbank, which is located at: www.sberbank.ru. The discreet page design can give odds to any other bank. Ease of use is hidden behind the unsightly appearance. Official website of Sberbank is one of the simplest, and most importantly, user-friendly. Here it is easy to find the information you are interested in, be it data on the products provided or tariff plans, which cannot be found on many websites of other banks during the day.

The main page of the official website of Sberbank consists of several “headers”. The topmost category is the categories of clients for whom the entire list of services provided has been prepared.

Lending

When you select any product, it opens detailed description. In addition to standard conditions, here you can find out how to get a loan, what documents to bring to the bank, what requirements are set for borrowers, etc.

Here you can familiarize yourself with the loan agreement, read the specific conditions in the lending rules, learn about ways to repay the debt, etc. One page contains the maximum information on one specific product, when, as on many websites of other banks, all the data is scattered across different pages and tabs. For this, the site receives a definite plus.

For convenience, you can calculate the loan using a special Sberbank loan calculator. It is not so convenient to use, because there are too many mandatory fields to fill out and half of them are absurd, for example, indicating gender. This factor may influence the decision on the application, but at the preliminary calculation stage it seems absurd. Here you can see only the monthly payment amount, bypassing such important data as the total cost of the loan.

Payment for services and transfers

The “Pay and transfer” tab will help clients learn about ways to pay for housing and communal services, cellular communications, the Internet, fines, loan payments, etc. Here are the commission rates for each transaction depending on the payment method (Internet banking, ATMs, mobile application, etc.). This tab also contains detailed conditions for money transfers within the country and abroad.

The “Invest and Earn” tab will help the client understand the choice of the appropriate service that Sberbank can provide (brokerage services, mutual funds, etc.) Information about coins for sale is also provided here.

Insurance

The “Insure yourself and property” tab will allow a current or potential client to insure an apartment, debit or credit card, life and health online.

Additional features

There are very convenient widgets on the main page of the site. For example, a currency converter, where online you can calculate dollars in rubles or other currencies at the bank rate; see the current euro/dollar exchange rate against the ruble and precious metals.

Sberbank was one of the first to develop a special project called “Simply Finance”. Here everyone can learn more about standard banking services and products in simple instructions and colorful pictures.

What is the most useful thing on the site and why? What is missing?

On the official website of Sberbank, everything is on point, everything is in its place. It will be easy for the user to find the necessary information on any bank product. The entrance to Internet banking is located in the most visible place - at the top of the main page. Below is a site map, where it will be even faster to find the right product.

But the biggest plus for Sberbank can be given for the fact that on each page of any product there are specific documents on it (exact conditions, tariff plan, agreement, etc.) Unfortunately, banks on their websites colorfully describe the same loans, indicating only summary information. And to find details, you have to search for relevant documents for a long time. Sberbank does not hide or “hide” anything; on the contrary, it puts everything on display. Plus for honesty.

Contact Information

Finding contact information for Sberbank on its official website is quite simple. The hotline number for free calls from any phone is indicated in the header of the main page of the site. The support number for Moscow and Moscow Region is also indicated; you can find all branches in a specific city.

At the bottom of the main page there is a special widget that automatically finds the nearest branch, ATM or terminal in your city. The user just needs to enter a street or metro station, select a service point and click the “Find” button.

Bank details (BIC, INN, correspondent account, etc.) are located in the bottom menu of the main page in the “About the Bank” - “Details” tab.

This page only provides information about Sberbank’s services and products and is in no way connected with the bank itself. All logos belong to their respective owners. This page only informs about Sberbank services. For exact product conditions and tariffs, please check with Sberbank branches.